Should we invest in Zomato’s IPO or not? Will our money double if we invest in Zomato's IPO? Or we may also have a loss. There will be many such questions in your mind. So today we are going to give you all the information related to Zomato's IPO.

So first of all, how much fund is Zomato going to raise through this IPO? So the answer is Rs 9375 crore. Out of which Zomato will get around Rs. 9000 crores which is a huge amount. Zomato is going to invest these Rs. 9000 crore in expanding its business.

So now it comes to investing, if Zomato is going to raise Rs 9000 crores from IPO, then only people like you and us will invest this money. But do you know, what should we, a common investor, think before investing money? Every expert investor, before taking shares of any company, sees the business model of that company, sees how much profit the company is earning, looks at everything from promoters' stake in the company to its liabilities, etc. And if all well, then an experienced investor invests in the shares of that company.

But do you know whether Zomato is a profitable company or not? So everyone knows the answer to it that "No", Zomato is booking losses every year, Zomato is not running in profit. So in such a situation should we go to invest in Zomato's IPO and buy their shares?

So why should we invest in Zomato's IPO?

So before you put your mind elsewhere, let us tell you that Zomato currently has 100 million active customers across the world. So you think that how long will it take for that company which has more than 100 million customers to become profitable. And apart from this, we should also keep an eye on the history of the company, its old investors, its future plans. Most of the new investors come in the talk of people and they invest in it without knowing the business model and future plans of the company, due to which they have to bear the loss.

So first we know about the history of Zomato.

As most of the investors know that earlier the name of Zomato was not Zomato, earlier it was named Foodiebay. Then the company changed its name to Zomato with a slight twist to Tomato. Apart from this, you should also know that Zomato got the first funding in 2010. In 2010, Zomato was funded by Info Edge of about $1 million, although even after this, Info Edge has funded Zomato several times, in 2010, Zomato got funding for the first time. Since then, Zomato started spreading its feet in the market. So no matter how much money Zomato earns now, but even today Info Edge gets the most benefit because Info Edge has maximum shares of Zomato. Let us assume that when Zomato's IPO comes, Info Edge is going to benefit the most, whose effect is also being seen in Info Edge's share price in the last 1 month.

What Zomato Does?

Well, 99 percent of people believe that Zomato's business is based only on food delivery, but it often happens that what we are seeing is not entirely true. Let me tell you why we are saying this. You must have read above that Zomato has been a constant loss, but you will be surprised to know that despite this, Zomato is constantly focusing on such opportunities from where it can get Tremendous growth as well as its investors.

Zomato has acquired a Sports Discovery startup Fitso for around Rs 80-100 crore. If we look from the long-term point of view, Fitso will be quite a profitable startup, especially as soon as this covid era is over, Fitso is going to boom in the market. Fitso is an app-based sports discovery startup, by taking membership of which you can take entry wherever they have partner GYMs, clubs, or sports campuses in India, you do not need to take separate membership for every place. So you have to think that if such businesses are coming into the market, then companies like Zomato are investing in them, then these companies can get very good growth and returns and at the same time, their investors also have a chance to earn good money. Everyone is talking about Zomato's food business, but where the company is investing its money behind the scenes, investors should also keep an eye on it.

While investing in zomato, things to keep in my mind

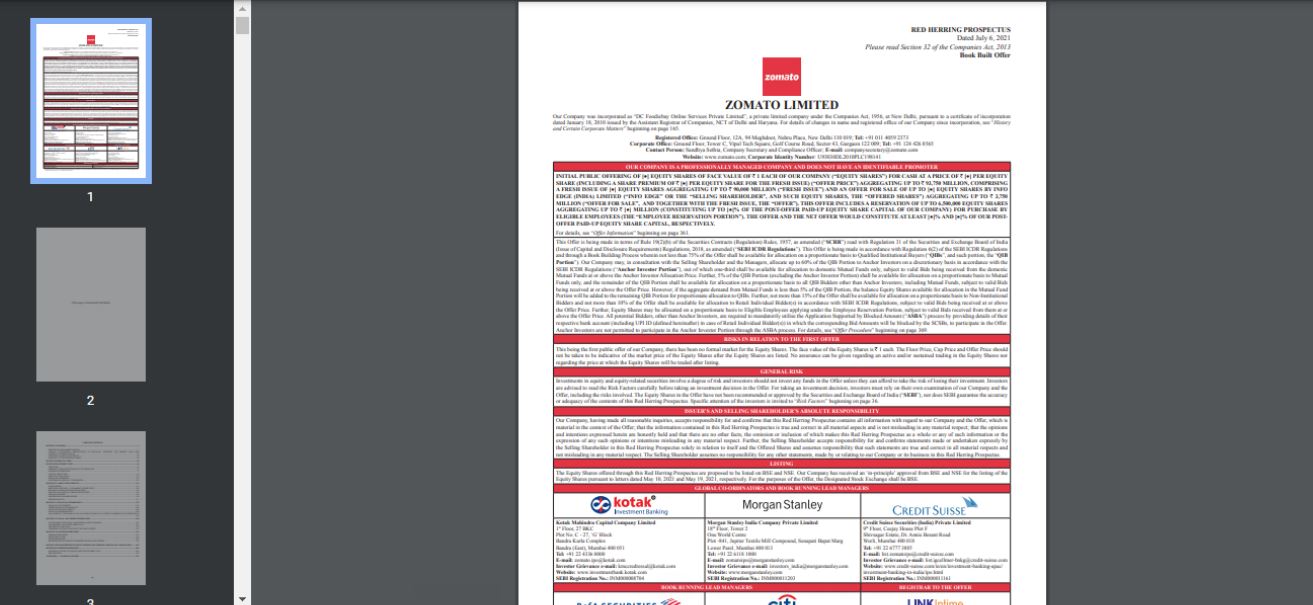

whenever a company brings its IPO, that company also brings its own Red Herring Prospectus. In which the company's past financials, company's profit/loss, order size, company's management, company's future plans and the money that will be taken from investors through IPO, what the company is going to do with that money, you will get complete information like this in this prospectus. Will get Now you have got all this information but we are going to give you the more detailed information.

Let's talk about Zomato's grey market premium

First of all, know what is grey market premium? There is no rocket science to understand this. Let us assume that if the price of a share is Rs 150 and if its grey market premium is Rs 300, then it simply means that people are ready to buy a share of Rs 150 in today's date for Rs 450 (Ex: 150 + 300).

So talking about the grey market premium of Zomato, then the grey market premium of Zomato is running 26% more than the listing price of Zomato, i.e. people are ready to pay 26% more money even today's date.

Now know what the difference reads, when the company is a list on the exchange, then the chances of people getting profit in it are also very high because people are more like to buy it in the grey market.

#1. What is zomato IPO date?

Zomato IPO Opening Date is 14 July 2021. You can apply for Zomato IPO from 14th July 2021.

#2. Zomato IPO Closing Date

Zomato IPO Closing Date is 16 July 2021. You have a total of 3 days to apply. You can apply for Zomato IPO only till 16th July 2021.

#3. Zomato IPO Issue Type

Issue Type of Zomato IPO is Book Building. Generally, there are 2 types of issue types, one is fixed price issue and the other is book building. In a fixed price issue, you get the shares at a fixed price only, but in book building, you get a price range in which you can place your corresponding bids.

#4. What is zomato IPO price?

Price Range for Zomato IPO is Rs.72 to Rs.76. Since this is a book building IPO, then you have the option to choose your price between the price ranges. You can place your bid between Rs.72 to Rs.76.

#5. Zomato IPO Lot Size

Lot Size of Zomato IPO is 195 shares. The lot size of Zomato IPO is 195 shares i.e. you will be required to buy 195 shares i.e. one lot.

#6. Zomato IPO Allotment Date

Allotment Date of Zomato IPO is 22 July 2021. After applying, if you get the IPO of Zomato, then you will be informed about it and you will be allotted shares.

#7. Zomato IPO Refund Date

Refund Date of Zomato IPO is 23 July 2021. Those who will not get the shares in the IPO will be given a refund on 23 July 2021.

#8. Zomato IPO Shares Credit in Demat Accocunt Date

Shares will reflect in your Demat account on 26 July 2021. If you are allotted shares of Zomato, then those shares will be reflected in your Demat account from 26th July 2021 onwards.

#9. Zomato Listing Date

Shares will reflect in your Demat account on 26 July 2021. If you are allotted shares of Zomato, then those shares will be reflected in your Demat account from 26th July 2021 onwards.

So now we come to the most important question that, should we invest in Zomato's IPO or not?

See what happens when there is a lot of buzz or hype about an IPO in the market, it means that many people want to take it, and if you get the shares because of your luck and at that time when the IPO is listed in exchange Because it has a lot of buzz in the market, that's why that IPO gives manifold returns to its investors. Your money can also double, but this happens only with good companies. Right now Zomato is definitely showing you loss-making but there are many such companies that may turn profitable soon and Zomato is one of them.

So now if you want to invest in IPO or invest in stocks then you need a Demat account. And if you do not have a Demat account, then you will find the links of India's top two Demat account providers Zerodha and Upstox below. Click on it and open your Demat account today.

- Click Here To Open Your Demat Account With Upstox

- Click Here To Open Your Demat Account With Zerodha

Read This Also:

To invest or trade in the stock market, you need a basic requirement, which is a Demat account. There are many authorized brokers in India where you can open your Demat account. But in this article, we will give you complete information about the top brokerage companies...

Read Full